1.0 THE FOUNDATION

1.1 INTRODUCTION TO FOREX MARKET

According to the Bank of International Settlements, foreign exchange trading increased to an average of $5.3 trillion a day. To simply break this down, the average has to be $220 billion per an hour. The foreign exchange market is largely made up of institutional investors, corporates, governments, banks, as well as currency speculators. Roughly 90% of this volume is generated by currency speculators capitalizing on intraday price movements.

Unlike the stock market and future markets that are housed in central physical exchanges, the foreign exchange market is an over0 the counter market, decentralized market completely housed electronically.

Though investors are familiar with the stock market they are unaware how small in volume it is in relation to the Forex Market.

In sum, the forex market size and depth make it the ideal trading market. This liquidity makes it easy for traders to sell and buy currencies. This is the reason why traders from all over the world are turning to the FX Market.

1.0.1 KEY BASIC POINTS

Forex stands for Foreign Exchange market

Forex traders trade international currencies

The Forex market is decentralized. This means that there is no one single Forex market, like in stock trading and local exchanges for example.

The Forex market is the largest financial market in the world

The Forex market is open 24 hours a day, 5 ½ days a week

Currencies are always traded in pairs

You can buy and you can sell currency pairs

1.0.1 Advantages of Trading the Forex Market

There are many benefits and advantages of trading forex. Below is a few reasons why so many people are choosing this market:

1. No commissions

No clearing fees, no exchange fees, no government fees, no brokerage fees. Most retail brokers are compensated for their services through something called the “bid/ask spread”.

2. No middlemen

Spot currency trading eliminates the middlemen and allows you to trade directly with the market responsible for the pricing on a particular currency pair.

3. No fixed lot size

In the futures markets, lot or contract sizes are determined by the exchanges. A standard size contract for silver futures is 5,000 ounces.

In spot forex, you determine your own lot, or position size. This allows traders to participate with accounts as small as $25 to $50.

4. Low transaction costs

The retail transaction cost (the bid/ask spread) is typically less than 0.1% under normal market conditions. For larger transactions, the spread could be as low as 0.07%. Of course, this depends on your leverage and all will be explained later in this trading course with Akonnor Owusu Larbi.

5. A 24-hour market

There is no waiting for the opening bell. From the Sunday evening 8:30 PM GMT to Friday Evening 9:00 PM GMT, the forex market never sleeps. This is awesome for those who want to trade on a part-time basis because you can choose when you want to trade: morning, noon, night, during breakfast, or in your sleep.

6. No one single person can manipulate the Market

The foreign exchange market is so huge and has so many participants that no single entity (not even a central banks of US and JAPAN) can control the market price for an extended period of time. This being said, Fundamentals do play a role in volatility. Fundamentals will be explained later.

7. Leverage

In forex trading, a small deposit can control a much larger total contract value. Leverage gives the trader the ability to make nice profits, and at the same time keep risk capital to a minimum. For example, a forex broker may offer 50-to-1 leverage, which means that a

$50 dollar margin deposit would enable a trader to buy or sell $2,500 worth of currencies. Similarly, with $500 dollars, one could trade with $25,000 dollars and so on. While this is all gravy, let’s remember that leverage is a double-edged sword. Without proper risk management, this high degree of leverage can lead to large losses as well as gains.

8. High Liquidity

Because the forex market is very large in size, it is also extremely liquid. This is an advantage because it means that under normal market conditions, with a click of a mouse you can instantaneously buy and sell at will as there will usually be someone in the market willing to take the other side of your trade. You are never “stuck” in a trade. You can even set your online trading platform to automatically close your position once your desired profit level (a limit order) has been reached, and/or close a trade if a trade is going against you (a stop loss order).

9. Low Barriers to Entry

You would think that getting started as a currency trader would cost a ton of money. The fact is, when compared to trading stocks, options or futures, it doesn’t. Online forex brokers offer “mini” and “micro” trading accounts, some with a minimum account deposit of $25. We’re not saying you should open an account with the bare minimum, but it does make forex trading much more accessible to the average individual who doesn’t have a lot of start-up trading capital.

10. Demo Platforms

Most online forex brokers offer “demo” accounts to practice trading and build your skills, along with real-time forex news and charting services. These services are all free. Demo accounts are very valuable resources for those who are “financially hampered” and would like to hone their trading skills with “play money” before opening a live trading account and risking real money.

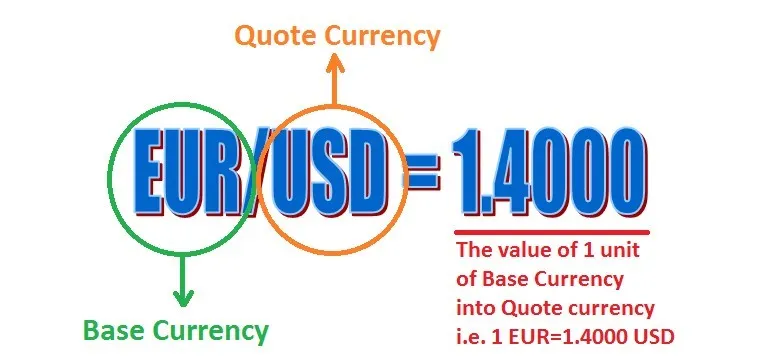

1.2 A Forex Pair

Currencies are always traded in pairs. This means Currencies are traded like AAA/BBB .In simple terms, one can buy and sell currency pairs.

The first currency in a currency pair is the base currency and the second one is the quote currency.

If there is a pair say, EUR/USD, you buy the base currency and sell the quote currency.

Every Forex pair has 2 prices:

1 — Ask price: The price sellers are willing to sell — The price you pay when you enter a buy trade

2 — Bid price: The price buyers are willing to pay — The price you pay when you enter a sell trade

The difference between the bid and the ask price is called the spread which is a cost of trading.

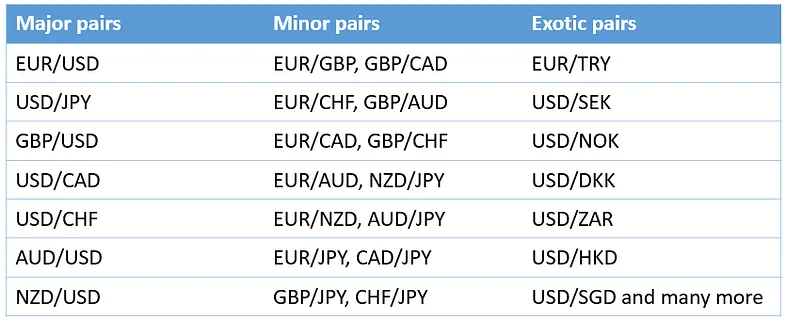

There are 3 different classes when it comes to Forex pairs: Majors (the most commonly traded),Minors and Exotic Forex pairs.

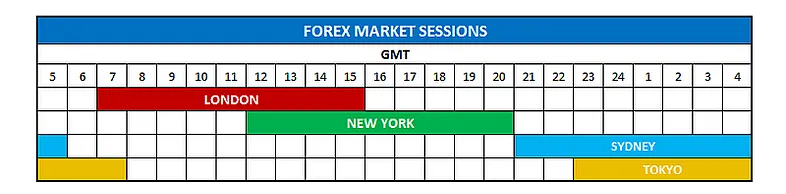

Individual currencies are most active during their own “trading session”

The table below shows the global Forex trading sessions. When the trading sessions overlap, you usually have the highest trading activity. The time is in Greenwich Mean Time. GMT is the mean solar time at the Royal Observatory in Greenwich, London, reckoned from midnight.

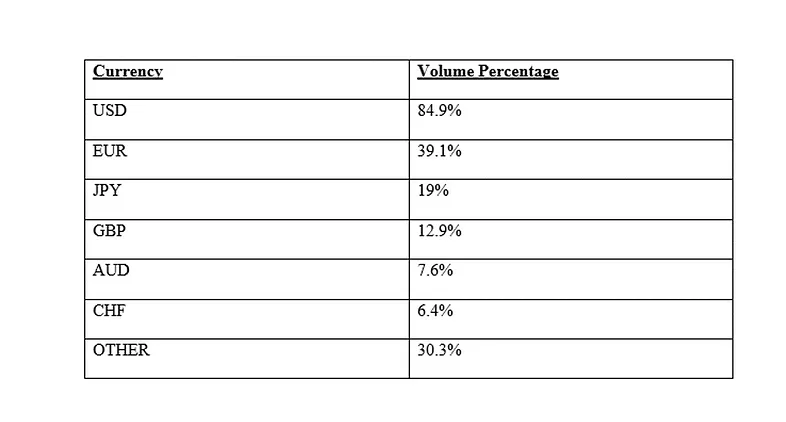

1.0.1 Turnover of Currency Pairs

1.1 TRADING PLATFORM

A trading platform is software through which investors and traders can open, close, and manage market positions through a financial intermediary. Online trading platforms are frequently offered by brokers either for free or at a discount rate in exchange for maintaining a funded account and/or making a specified number of trades per month.

Often times, trading platforms will come bundled with other features, such as real-time quotes, charting tools, news feeds, and even premium research. Platforms may also be specifically tailored to specific markets, such as stocks, currencies, options, or futures markets.

Trading platforms may have specific requirements to qualify to use them. For example, day trading platforms may require that traders have at least $25,000 in equity in their accounts and be approved for margin trading, while options platforms may require approval to trade various types of options before being able to use the trading platform.

They are many Trading platforms. These include:

MetaTrader 5— MetaTrader 5 is a platform for trading Forex, analyzing financial markets and using Expert Advisors. Mobile trading, Trading Signals and the Market are the integral parts of MetaTrader 5 that enhance your Forex trading experience.

Interactive Brokers — Interactive Brokers is the most popular trading platform for professionals with low fees and access to markets around the world.

TradeStation — TradeStation is a popular trading platform for algorithmic traders that prefer to execute trading strategies using automated scripts developed with Easy Language.

TDAmeritrade — TDAmeritrade is a popular broker for both traders and investors, especially following its acquisition of ThinkorSwim and the development of the Trade Architect platforms.

1.0.1 Understanding Metatrader 5 (MT4 older Version)

Metatrader 5(MT5) is the most popular trading platform among retail traders. It is simple enough for beginners to start trading with MT4 or MT5, as their first platform, but its advanced functionalities (such as dozens of built-in indicators, graphical tools, the ability to run trading robots, EAs) make it perfect for intermediate or even advanced traders.

7 Easy Steps

1. Download MetaTrader 5/MT5. The first step is to get MetaTrader 5 downloaded onto your computer or laptop or mobile phone. …

2. Follow your Computer’s Prompt. …

3. Tick the License Agreement Box. …

4. Click Finish..…

5. Open an Account. …

6. Input your Details. …

7. Save your Login and Password.

1.0.1 How to open and configure a chart in MT4 or MT5?

After installing Metatrader5 on your computer or mobile phone, the graphics in the terminal are displayed in a standard way. But all traders visually absorb information in different ways, that’s why MT5 provides the ability to change the options of charts to display them in accordance to your desires.

Standard settings are not suitable for analyzing the price movements for many traders, so if you want to change something, you can reorganize the scale, period, and the color of charts. In general, MT5 provides many functions for modifying graphs, and below I will tell about it in details.

1.0.1 Opening of the new graphics

To open a new chart in MT5, you can use one of the next ways:

1. Open the window “market watch”, click the right mouse button on the desired currency pair and choose the menu item “Chart Window”.

2. On the toolbar, click the + button , then select a group of trading instruments from the drop down list.

1. Follow the path: “Window” — “New window”, then repeat step 2.

2. Follow the path: “File” — “New schedule”, then repeat step 2.

Please note: only characters opened in the window “market watch” will be displayed in the list of trading instruments.

To display all symbols, press the right mouse button on any field of the window “market watch” and click on the row “Show all symbols”.

1.0.2 Zoom

The scale of the graph plays an important role in the observation of price movements. Zoom allows you to focus on the details while reducing the figure gives an opportunity to look at the General trend.

In MT4, you can use several ways to change the chart scale:

2. Go to the “Charts” in the main menu bar — “Increase” / “Decrease”;

3. Hold down the Shift + / — (“plus” or “minus”);

4. On the toolbar ;

5. Anywhere in the active window open the context menu by pressing the right mouse button and then refer to the command “Increase” or “Decrease”.

1.0.1 Changing time frames

if you need to determine the exact point to enter the market, You should choose a narrow time frame for plotting. However, for assessing the General trend you need a wide timeframe. When you have built the graphic, you can change time periods in the following ways:

· Go to the tool bar “chart Period”, which includes all possible time frames;

· On the toolbar the “Charts” click on the button

· In the active chart window of the shortcut menu invoked by the right mouse button, select “Period”;

· Follow the path: “Graphics” in the main menu bar — “Period”.

1.0.2 Changing the type of chart display

MT5 offers traders to switch between different chart types easily. Clicking on “Graphics” in the main menu bar you can choose the visualization of the line chart, bar chart, and the Japanese candlestick chart. The same function is available in the toolbarL: just click on the corresponding icon. You can also use Alt+1, Alt+2, and Alt+3

1.0.3 Color changing graphics

On MT5, a trader can change the chart color for his own convenience by clicking on the trend line in the popup menu chooses “Properties”. In the next window, you can define the color of each element of your schedule in the tab “Colors”.

On the terminal, three color versions are set automatically for graphics. In the “Color scheme”, you can select the yellow graphics on a black background, it is also possible to choose green on a black background, and for conservative traders there is a black-and-white palette. In addition to autocomplete in the right box you can choose the color of each element separately

1.0.1 Saving graph settings on the terminal with templates

MT4 has a built-in ability to save and then select a previously configured graph. This eliminates the need to adjust every time the visualization window. With one click You can apply a favorite solution that will allow You to analyze the price movement quickly. MetaТrader allows you to save these properties:

· color scheme;

· timeframe (period of time);

· indicators with all the settings;

· graphic tools (in this case, price values are also saved on the new graph and you will have to adjust);

· chart scale;

· the type of graph;

· attached the TA and all its settings.

In order to save all settings in the database, just press the save button on the toolbar, then select “Save template”

A similar option is available under “Graphics” in the main menu bar — “Template” — “Save template” or in the context menu of the graph.

For activating a saved template, click on the button

, then on “Load template”. Once you find the desired version of the template, click “Open” and the graph will be shown in the right

way. You can remove a template by a similar way, choosing the line “Remove template”.

With all these, you can equally trade on your mobile phone by downloading MT5 from Play Store or The App Store.

1.4 THE TRADING ORDER TYPES

Here are the basic trading order types:

1.4.1 Market Order

A Market order is the simplest order type. There are market orders to buy and market orders to sell. A market order gives you whatever price is available in the marketplace.

1.4.2 Buy Limit Order

A Buy Limit is an order to buy that is placed below the current price. The order is only filled* at or below the limit price.

1.4.3 Sell Limit Order

A Sell Limit is an order to sell (or short) that is placed above the current price. The order is only filled at or above the limit price.

1.4.4 Buy Stop Order

A Buy Stop is an order to buy that is placed above the current price. The order is only filled at or above the stop price.

1.4.5 Sell Stop Order

A Sell Stop order is an order to sell that is placed below the current price. The order will only be filled at or below the stop price.

1.4.6 Buy Stop Limit

A Buy Stop Limit order is very similar to a Buy Stop order, except that it doesn’t act like a market order. The buy stop limit will only fill at the buy stop limit price or lower.

1.4.7 Sell Stop Limit

A Sell Stop Limit Order is very similar to a Sell Stop order, except that it doesn’t act like a market order. The sell stop limit will only fill at the price equivalent to the limit price attached to the order, or higher.

Getting used to all the trading orders can be a bit confusing at first, and there are more order types than this!. Putting out the wrong order type when money is on the line can cause big problems.

2.0 THE BASICS

2.0.1 CURRENCY VALUE

The value of a currency pair Is determined by the strength or weakness of the base currency in relation to the quote currency. The base currency is almost 1 for most currencies. This means that, when you see a quote of 1.4567 EURUSD, its value is 1 EUR will buy 1.4567 of USD. If you sell EURUSD from 1.4567 to 1.4557, you would have made a profit of 10 pips.

2.0.2 WHAT IS A PIP?

PIP stands for Price Interest Points. There is Standard lot ($100,000), Mini Lot ($10,000) and Micro lot ($1000). In the standard lot, a pip worth $10. Mini lot its $1 and its worth $0.1 in micro lots. However, each currency has its own pip value.

2.0.3 PIP VALUE

The table below shows the value of a pip in each currency Pair. Remember, currencies are traded in pairs.

These values changes slightly based on the actual exchange rates, but the fluctuations are very minor.

2.0.4 AVERAGE DAILY PIPS

Getting to know the average daily pips movement is crucial in calculating profit and loss. It helps in entry price levels and getting out of the market as early as possible. The table below shows the six (6) major pairs and their average pips pulled per day.

2.0.5 TURNOVER OF THE SIX MAJOR PAIRS

Turnover is an aggregated cost of all trading deals in as specified time period. In technical analysis, the turnover measures efficiency and intensity of assets allocation. In simple terms, the turnover is the total volume of all transactions in a given time period.

2.0.6 THE US-INDEX

The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners’ currencies. The Index goes up when the U.S. dollar gains “strength” (value) when compared to other currencies. Pay close attention to the US-Index. The US- Index sets the tone for a lot of currency moves. It can help you price analysis and trade timing in the forex market.

It is a weighted measure using the dollar’s movements relative to other select currencies in an attempt to represent major trading partners. The current mix is approximately:

· 57.6% Euro (EUR)

· 13.6% Japanese Yen (JPY)

· 9.1% Canadian Dollar (CAD)

· 4.2% Swedish Krona (SEK)

· 3.6% Swiss Franc (CHF)

The basket was altered in 1999 when the Euro replaced several European currencies. It still includes the Swedish krona and the Swiss franc despite the fact that China, Mexico, and South Korea are more important trading partners.

2.0.7 GLOBAL TRADING SESSIONS AND WHEN PAIRS MOVES

Although the forex market is open 24 hours, 5 ½ days, it is however important to keep track of the individual trading sessions as they Impact FX rates and volatility significantly.

It is vital to understand that a currency moves most when their local market is open. The most active trading session is when London and New York overlap, thus from 12:00 to 15:00 GMT each trading day.

2.0.8 THE IMPORATNCE OF CLOBAL TRADING SESSIONS

The trading session impacts multiple trading decisions on multiple levels. These include:

1. Market Selection

Choose a pair that is most active when you are infront of your charts. Choosing a pair that is not active during your trading can suck you in low volatility and boring price moves.

1. Good Entries and Exist

Before entering a trade, make sure to analyse price in context to the current trading session and then make your decisions accordingly.

2. Breakouts during active session

A Breakout that occurs during a pair’s actual trading session is much more likely to succeed. For example, a breakout move in USDCAD that happens during US trading sessions is more likely to succeed.

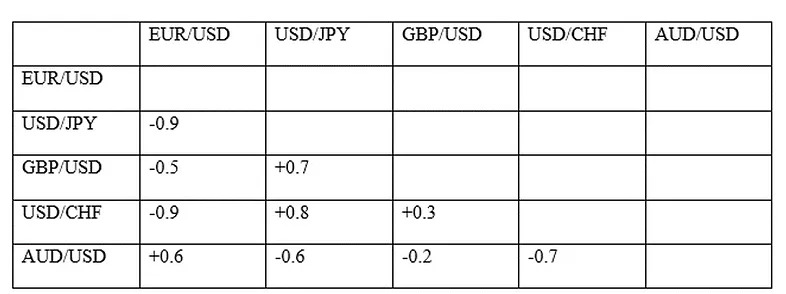

2.0.9 FOREX RATES CORRELATION & RISK IN TRADING

For risk management sake, apply the strongest position and negative correlations; +1 or _1 or –

!00%. A positive correlation means the market will move in the same direction. A negative correlation means it will move in opposite direction.

2.1.0 RISK MANAGEMENT

It is important to know that, trading moving currency pairs with a high positive correlation, you are increasing your risk as both pairs are moving in same direction. This means, there is likelihood of either having 2 winning or 2 loses at the same time.

2.1.1 LEVERAGE

Leverage is an investment strategy of using borrowed to increase the potential returns of an investment. Leverage allows you to enter a position or trade that is larger than your capital.

Leverage in Forex can be in the forms 1:100

1:200

1:300

1:400

1:500

For instance, a leverage of 1:100 means if you have $10,000, you can control an account size of

$ 1,000,000. The higher the leverage, the higher the win and vice versa.

2.1.0 SPREAD

Spread is the difference between the bid and ask. It represents brokerage service costs and replaces transactions fees. Spread is traditionally denoted in pips — a percentage in point, meaning fourth decimal place in currency quotation.

Types of Spreads in Forex

Fixed spread — difference between ASK and BID is kept constant and do not depend on market conditions. Fixed spreads are set by dealing companies for automatically traded accounts.

Fixed spread with an extension — certain part of a spread is predetermined and another part may be adjusted by a dealer according to market.

Variable spread — fluctuates in correlation with market conditions. Generally variable spread is low during times of market inactivity (approximately 1–2 pips), but during volatile market can actually widen to as much as 40–50 pips. This type of spread is closer to real market but brings higher uncertainty to trade and makes creation of effective strategy more difficult.

A trader needs to cover spreads in winning trades before making a profit. For example, let’s take EUR/USD, the price of 1.4652 which is the bid and 1.4650 which is the ask price. This means that the spread charge is 2 pips. Therefore, in the case of selling USD, if price moves to 1.4552,

there is a successful pull of 100 pips. However, a spread of 2 pips will be deducted, making the investor basket 98 pips.

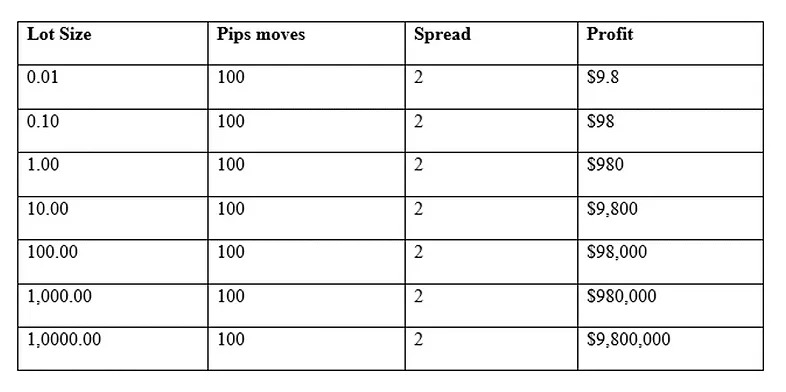

2.1.2 LOT SIZE

The pip value depends on the lot size you enter a trade with. Lets take the EURUSD example again. At the price of 1.4652 and leverage of 1;100, if an investor sell with lot size of 0.01, when it moved to 1.4552, the 98pips would produce $9.8.

The table below shows how much profit can be made with different lot sizes.

2.1.2 Calculating Pip Value

Trading EURUSD, with account in USD, one pip = 0.001 Let say your trade accounts is $10,000

0.001*10,000 =10

If the exchange rate is 1.13798 10/1.13798=8.7875007

Therefore a pip of EURUSD @ a value of 1.13798 worth $8.79 For metal, you calculate thick value instead of pip value.

Rick value=tick in decimal(0.01) *number of trading lot of 100oz

=0.01*100

=1

Each tick is worth $1.

Modules & Content Structure to follow

Below you find some of the modules that await you.

You can equally join over 500,000 people benefiting from my articles.

1. Setting up trading charts

2. Introduction to trading principles

3. Chart reading foundation

4. Getting to know your trading tools

5. Signal introduction

6. Step-by-step setup exploration

7. Master all my setups

8. Finding the perfect entries

9. How to set effective stops

10. Defining the best targets

11. How to manage a trade

12. When to cut a losing trade

13. Position sizing

14. Risk management

15. Market selection and trading plans

16. Dealing with news events

In addition, these are the 7 price action you could master when you sign up for our Newsletter

1) Trading with trendlines -Mastering trend structure

2) The best chart patterns

3) Drawing support and resistance the right way

4) How to use the Fibonacci tool

5) The Pinbar trading signal

6) Clean vs messy charts

7) Multi timeframe analysis

Thank you for reading. — Akonnor Owusu Larbi